FAQ's

Investing in Diversified Commercial Real Estate

We help busy professionals create passive income and gain financial peace of mind through real estate investments.

What is the minimum investment amount for projects offered?

The minimum to place capital into the fund is $50,000. However the minimum project specific investment typically ranges between $10,000 – $30,000. Additional shares are typically offered in increments of $5,000 above the minimum.

Who Can Invest?

We diversify in both debt and equity investments as well as diversification across multiple asset classes. In these diversifications we have different securities and debt offerings for accredited partners.

Am I an Accredited Investor?

An accredited investor, in the context of a natural person, includes anyone who:

• earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two years, and reasonably expects the same for the current year, OR

• has a net worth over $1 million, either alone or together with a spouse (excluding the value of the person’s primary residence).

• executive or manager in the company offering the security, holds qualifying valid equity broker or financial advisor license, or demonstrate professional knowledge of private securities

In addition, entities such as banks, partnerships, corporations, nonprofits and trusts may be accredited investors. Of the entities that would be considered accredited investors and depending on your circumstances, the following may be relevant to you:

• any trust, with total assets in excess of $5 million, not formed to specifically purchase the subject securities, whose purchase is directed by a sophisticated person, or

• any entity in which all of the equity owners are accredited investors.

In this context, a sophisticated person means the person must have, or the company or private fund offering the securities reasonably believes that this person has, sufficient knowledge and experience in financial and business matters to evaluate the merits and risks of the prospective investment.

What are the returns and how are they calculated?

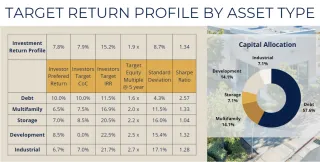

The returns will vary on the investment type and if you invest in equity or debt. However for an equity investment we underwrite our deals to deliver an average annual return between 15%-20%. Overall we’re looking for 2x ROI (Return on Investment) over the life of the investment (typically a 5 -7 year hold) with a good portion of that return coming from the sale of the property. Debt investments will have a fixed rate and will deliver an annual percentage yield of 10%Image

What are the risks?

Direct or indirect purchases of real property involve significant risk including loss of value. In deciding whether to invest in a Rise Capital Investments investment opportunity or any other investments, prospective investors should read the entire Private Placement Memorandum and associated Risk Disclosures. Potential investors should always consult an investment advisor, accountant, and attorney prior to making any investment decision.

What are the tax benefits?

Real Estate syndications are extremely tax efficient. In a limited partnership with Rise Capital Investments, you will benefit from your portion of the investment’s deductions for property taxes, loan interest and depreciation. We also like to use a cost segregation strategy to accelerate depreciation. It’s not unusual on a $100K investment to return actual cash in your pocket of $8K while experiencing a paper loss on your annual K-1. That loss can then be used to offset other income. At time of sale the partnership gains are treated as long-term capital gains and then rolled into another syndication to mitigate the gains.

You can also further decrease your taxable liability by using self-directed Roth IRA so that you can receive the benefits of your investment absolutely tax free! A self direct IRA or a solo 401k are additional investment vehicles. For more information, please read this article.

Do we invest in our own offerings?

We have absolute confidence in our ability to network with experienced sponsors and we thoroughly pre-screen each deal through a systematic due diligence and underwriting process. With this confidence we will place our own capital into each opportunity that is shared with our partners.

What is a K-1?

K-1 is a tax form used by partnerships to provide investors with detailed information on their share of a partnership’s taxable income. As an equity partner in the LLC that purchases the properties, you will receive a K-1. Partnerships are generally not subject to federal or state income tax, but instead a K-1 is issued to each investor to report their share of the partnership’s income, gains, losses, deductions and credits. The K-1s are provided to investors on an annual basis so that each investor can include K-1 amounts on his or her tax return.

What is a PPM?

The Private Placement Memorandum is required by the SEC and describes the offering and risks. It includes the partnership agreement, investment summary and subscription agreement. It is a lengthy legal document (approx. 100 pages) prepared by a syndication attorney. The subscription agreement section includes basic information as to amounts being purchased and percent ownership. The risk section highlights just about every possible risk that could potentially occur.

Why invest in debt?

Debt investments tend to be less risky and have a significantly shorter time horizon than equity investments but usually offer a lower more consistent return. The debt investments will be a fixed return, with no upside potential like you might see in equity investments. Returns will typically be higher than what you would receive in your traditional brokerage account in the equities market. Debt investments are less volatile than common stocks, with fewer highs and lows than the stock market. The bond and mortgage market historically experiences fewer price changes, for better or worse, than stocks. For more information, please read this article.

What is a Trust Deed in First Lien Position?

All of our debt investments as secured by real estate collateral in first lien position using a Trust Deed as the instrument, which basically means that the note will be satisfied before any other liabilities and a first lien position has priority in case a debtor defaults and collateral has to be liquefied to settle the debt. Here is an article giving you more information on Debt and Trust Deed.

What is LTV?

LTV stands for Loan-To-Value. This refers to a ratio of the size of the loan compared to the value to the collateral. An LTV ratio is calculated by dividing the amount borrowed by the appraised value of the property, expressed as a percentage. For example, if you buy a home appraised at $100,000 for its appraised value, and make a $10,000 down payment, you will borrow $90,000. This results in an LTV ratio of 90% (i.e., 90,000/100,000).