Rise Capitals Articles To Educate And Inspire

The Power of Real Estate Debt Funds

"Do not save what is left after spending, but spend what is left after saving." – Warren Buffet

Diversifying Beyond the Equities Market

The world of investing is filled with various opportunities, with real estate debt funds offering a particularly interesting prospect. These funds offer an alternative route for investors to diversify their portfolio, providing an entry point into both the residential and commercial real estate markets through debt investment. But what is a real estate debt fund, and why should you consider it as an alternative or supplement to the equities market?

Let’s explore.

Understanding Real Estate Debt Funds

Real estate debt funds are pools of capital that provide loans to potential or current real estate owners. These funds operate in both residential and commercial spaces, offering short-term financing for various property types, from multifamily residences to shopping centers. The loans provided are usually secured by physical properties in first or second lien positions.

Investors in these funds earn income through regular interest payments on the capital loaned out. The fund specializes in a specific investment strategy, catering to borrowers with complex financial situations or those who might not qualify for conventional credit. Common loan types offered include bridge loans, construction loans, and property rehabilitation loans.

The Benefits of Investing in Real Estate Debt

One of the key benefits of investing in real estate debt funds is the potential for steady and attractive returns. With estimated returns of 9-11% cash on cash, real estate debt funds can outperform many other traditional investments.

Additionally, real estate debt funds offer a level of stability and security. The loans are backed by physical property assets, meaning that even in the event of a borrower's default, the fund can take possession of the property and sell it to recover the loaned capital.

Furthermore, these funds provide a steady income stream, irrespective of market conditions, which can be particularly beneficial during economic downturns. They offer a way to diversify your investment portfolio beyond the equities market and mitigate the risks associated with market volatility.

Why Consider Real Estate Debt Funds over the Equities Market?

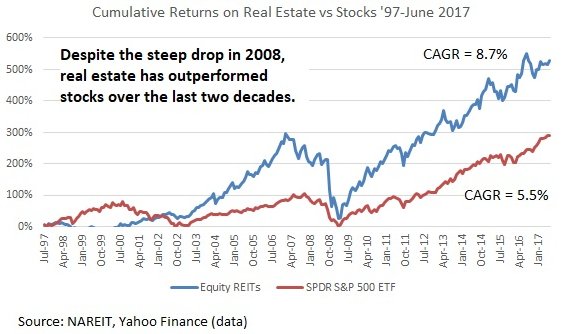

While the equities market can offer significant returns, it also comes with inherent volatility. The value of stocks can fluctuate dramatically based on a multitude of factors, leading to potential losses.

On the other hand, real estate debt funds offer a more predictable return on investment. They provide a steady income stream through regular interest payments, irrespective of market conditions and often times will give you a higher return. The fact that these investments are backed by physical assets further reduces the risk, providing a layer of security not present in the equities market.

Moreover, the diversification provided by real estate debt funds can enhance the overall health of your investment portfolio. By spreading your investments across various sectors, including real estate, you can reduce the risk of significant losses when one sector underperforms.

Equity vs. Debt in Real Estate Syndication: Understanding the Risk-Return Profiles

Investing in real estate syndication offers individuals the opportunity to participate in significant real estate projects that were previously out of their reach. Real estate syndication involves pooling resources from several investors to finance a project, either through equity or debt. Understanding the differences between these two investment options, their risk-return profiles, and how they fit into your overall investment strategy is crucial.

Investing in Debt: Lower Risk, Predictable Returns

When you invest in debt in a real estate syndication, you essentially act as a lender to the project. You lend money to the project and receive regular interest payments in return, much like a bank giving out a loan. The principal is typically repaid either at the end of the loan term or through a refinancing event.

The returns on debt investments are generally lower than those on equity investments, but they are more predictable and usually less risky. This is because debt investments are secured by the property. If the project encounters financial trouble, debt investors have a senior claim on the property and its cash flows before equity investors. This means you have a higher likelihood of recovering your investment if the deal goes south.

Debt investments tend to be more stable and consistent, making them a good option for investors seeking regular income and capital preservation. Their risk-return profile suits conservative investors who value the security of their capital and a steady cash flow.

Investing in Equity: Higher Risk, Higher Returns

Equity investments in a real estate syndication involve buying a portion of the property or project. As an equity investor, you are a part-owner of the project and your returns are derived from the property’s profits. This could be through rental income or from the sale of the property.

Equity investments offer the potential for higher returns compared to debt investments. However, they also come with higher risk. Your investment is directly tied to the performance of the property. If the property does not perform well, your returns could be low or even result in a loss.

The risk-return profile of equity investments suits investors with a higher risk tolerance and a longer investment horizon. The potential for higher returns may justify the increased risk for these investors.

Balancing Debt and Equity in Your Portfolio

A balanced investment strategy often involves a mix of both debt and equity investments. The proportion depends on your individual risk tolerance, investment horizon, and income needs. A well-diversified portfolio could help mitigate the risks associated with equity investments while still providing the potential for higher returns.

In conclusion, whether investing in debt or equity in a real estate syndication, understanding the differences, risks, and potential returns is key. Both offer unique benefits, and a balanced portfolio often includes a mix of both. As with all investments, thorough due diligence and consultation with a financial advisor is essential before diving in.