Rise Capitals Articles To Educate And Inspire

SYNDICATION GROUP BUYS

"Syndications let you invest capital while others manage operations, reducing your business risk and providing potential profits without daily management burdens."

Rise Capital Investments

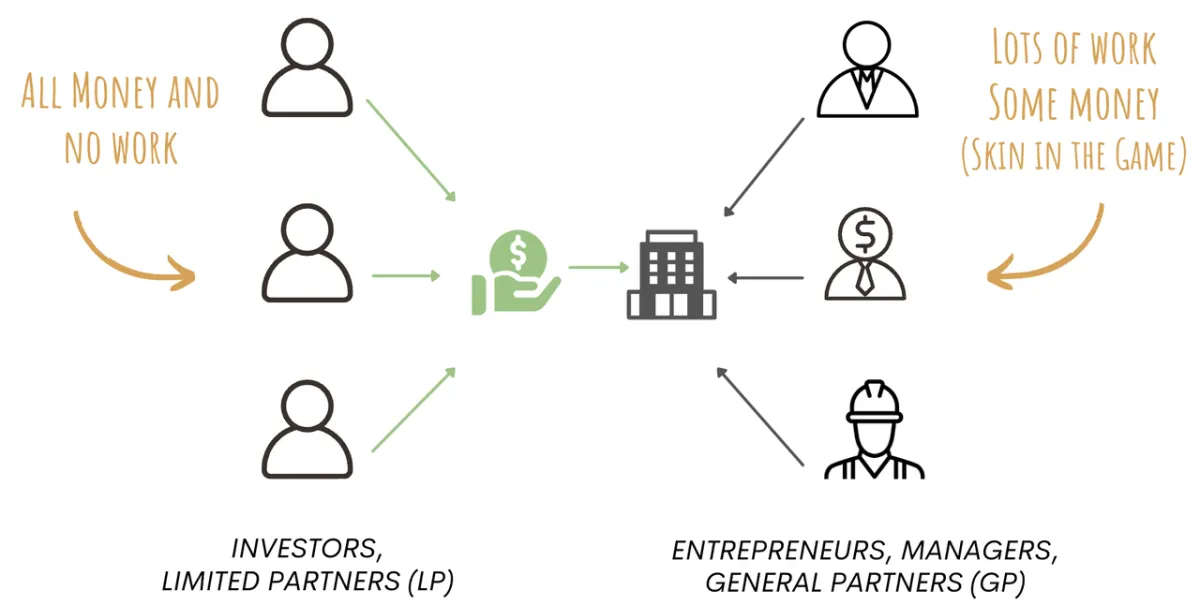

In the financial world, the word "syndication" just means people getting together to do a project together. Some provide money, others provide experience, and still more provide the work needed to run the day-to-day business.

Syndications are a fantastic way to both specialize and diversify by contributing where you bring the most value and work with a team to accomplish bigger projects that need more human and capital resources.

SYNDICATION: FINANCIAL DEFINITION

"A syndicate is a temporary alliance of business partners.

Syndicators join together to manage a large transaction that is difficult or impossible to effect individually.

Syndications often involve a pool of passive investors (Limited Partners) to provide capital to purchase a property or business managed by one or more entrepreneurs (General Partners)."

Source: www.investopedia.com/terms

LIMITED PARTNERS

Financial securities involve “Limited Partners” (LP) and are Regulated by the Securities and Exchange Commission (SEC) because LP’s do not control the business activities, they enjoy extra protections that managing business owners do not.

The US Supreme Court in SEC v. Howey 1946 define a “Limited Partner” as

“A person or entity [who] invests money in a common venture and is led to reasonably expect profits derived from the entrepreneurial or managerial efforts of [others].”

A security is an investment of money with little to no ongoing work

There is an expectation of profits from the investment

The investment of money is in a common enterprise

Any profit comes from the efforts of a promoter or third party

Under the “Howey Test” Ruling, persons investing in such a security are limited partners both in liability and any possible loss amounts to no more than the amount of their investment.

Limited Partners (LP) invest capital while managers or General Partners (GP) contribute work.

PROTECTION AND TRUST

When giving up control of a business after you invest money, you exercise both trust in another to handle your capital with expertise while you focus on another area of your own expertise as well as invoke protections.

2024 is filled with stories of real estate properties and businesses making higher loan payments on variable debt that skyrocketed beyond even the most conservative projections, both with the higher interest rates and paying for increasingly expensive interest rate caps.

As projects underperform in the face of higher payments and less money going into running the actual business, many investors are finding their projects under performing and some have even faced a total loss of capital on some properties or business investments.

However, there is another layer to this loss that limited partners may not realize they are enjoying. LP's understand they do no work, a pro and a con depending on your ability to identify and trust expert managers.

Limited partners are "off the hook" for working the business, and are therefore also not "off the hook" for any outstanding debt the business must pay back, and in some cases the manager might have to pay back from personal assets.

LP's are also not subject to any legal or regulatory liability from lawsuits or investigations from anything like a "slip and fall" case or raising capital with unethical assertions or company structures.

A good manager will protect the business in all but the most daunting economically challenging times. A good limited partner will invest carefully to avoid loss, but also to understand that loss is limited and invest accordingly.

Syndications offer the ability to diversify while avoiding much of the risk of running a business from time spent, legal issues, regulatory compliance, or ongoing financial losses from paybacks or clawbacks.

In exchange for proper due diligence and trust amid lack of control, limited partners in a syndication reduce business risk while enjoying more free time and upside in a deal.

Use the syndication tool wisely to build your wealth.