Rise Capitals Articles To Educate And Inspire

Red Pill vs Blue Pill: There are Only Two Options

"Waiting for election results to decide your next move costs you valuable time in compounding. The most successful investors prepare early for a variety of outcomes, start executing their worst-case scenarios, and pivot as needed. The time to act is now."

Rise Capital Investments

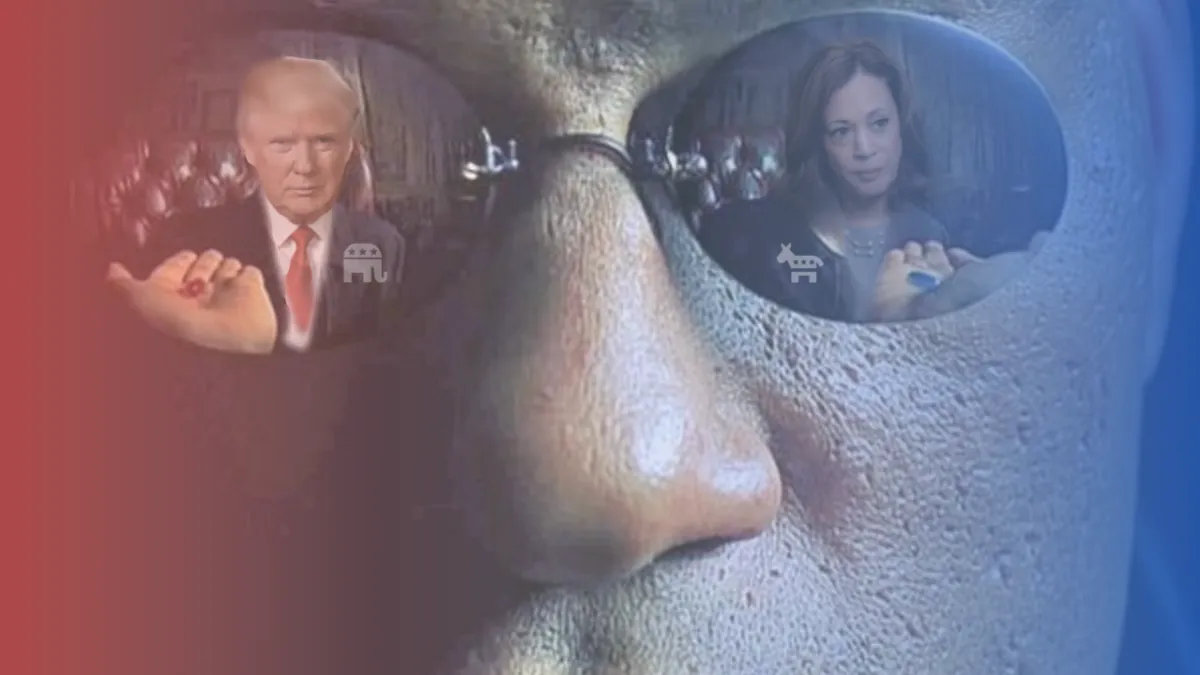

Red Pill vs Blue Pill: There are Only Two Options

Create Plan A and Plan B to Beat Investor Uncertainty

As the upcoming U.S. presidential election approaches, many real estate investors are feeling uncertainty, wondering how the outcome will affect their portfolios. It’s tempting to sit on the sidelines and wait for the results to guide your next move. But the truth is, waiting could be the riskiest decision of all.

We may not yet know which pill Americans will collectively choose, and in a global economy, the entire world is watching and waiting. However, experienced investors understand there is simplicity in planning with a 2-party system as there are only 2 possible outcomes: it's either a Red winner or Blue winner!

You don’t need to predict the future. What you need is to prepare for both outcomes—and that means having a solid plan for whichever happens.

As investors, we need to prepare for either potential outcome by creating two clear plans: one for a Candidate Red victory and another for a Candidate Blue victory. Then start executing the worst-case scenario before the election results are in.

Letting the election results dictate your financial future is unwise: it's giving up too much control to circumstances we can't directly control. But plowing ahead trying to ignore the impact one candidate or other will create is also foolish.

Create 2 plans now, one for each outcome: assign Plan A for a worse case scenario in your particular investing situation, and start executing it. If the election results are your preferred outcome for your goals, pivot to Plan B. By planning ahead, you ensure that your real estate portfolio is prepared for the shifts, no matter which candidate wins.

In the Rise Capital Investments fund, we diversify our real estate by focusing on cash-flowing short-term acquisition and renovation loans, and keep our equity offerings to no more than 30% of our total portfolio. Let’s explore how we can act now and pivot quickly if needed to preserve our commercial real estate equity investments and private loans for success under either outcome.

Why Real Estate Investors Can’t Afford to Wait for the Election

Uncertainty is an investor's worst enemy. Markets react quickly, and if you’re waiting for clarity after the election, you’ll already be behind. This election will likely bring changes to tax policy, regulations, interest rates, and government spending—all of which will impact real estate investors.

Over assuming that the choice of president will violently impact our financial fortunes is also assigning too much power to one event: our system is designed for slow change, not revolutionary swings. Economic policy still heavily relies on the makeup of the legislature, which has been historically polarized and unproductive in recent years, and appointed officials at the Federal Reserve.

As Elon Musk once said, "Being US President is like being captain of a large ship with a small rudder - there's a limit to how much damage they can do."

Prepare for either outcome, but a "secret" Plan C is to expect more of the same business as usual for at least for several months of a new administration that require little change in our approach as events slowly unfold.

Possible Plans for Either Outcome

🔵 Plan 1: If Candidate Blue Wins

If Candidate Blue wins, we can expect certain policy shifts that will significantly impact the real estate market, particularly in the areas of tax policy, government spending, and regulation.

1. Prepare for Potential Tax Increases

Candidate Blue’s policies may not renew the $3.4-4.7T in tax provisions set to expire before the end of 2025, so a Blue win is predicted to include higher taxes on capital gains, corporate profits, and high earners, especially those in the lower "accredited investor" income group. For commercial real estate investors, this could mean lower after-tax returns on sales or distributions.

To prepare, consider strategies like:

Harvesting capital gains before policy and tax changes take effect to lock in today’s lower tax rates.

Exploring tax-advantaged investments, such as those in Opportunity Zones or with depreciation.

Investing in private credit through tax-deferred retirement accounts like IRAs to minimize tax exposure on active income such as earned from interest on private loans.

2. Shift Focus to Sectors That Benefit from Government Spending

A Blue victory could bring a wave of government investment in sectors like renewable energy, infrastructure, affordable housing, and healthcare. These industries are likely to see increased demand for real estate, offering opportunities for both equity investors and private lenders.

For example, multifamily housing could become a more attractive asset class under a Blue administration as government spending may help drive demand.

Rise Capital is already positioning to acquire more of these growth areas by focusing private equity investments in multifamily, RV and mobile home parks, and industrial properties.

3. Potential Increased Regulation

Predict tighter regulations across industries, particularly in sectors like energy, healthcare, and financial services. This could mean more scrutiny and regulatory compliance, which could slow down deal flow in certain areas like new construction permits.

But tighter regulations also create opportunities for well-prepared investors. Green energy projects and sustainable building initiatives, for example, may receive government backing, offering lucrative borrowing options with less competition.

🔴 Plan 2: If Candidate Red Wins

A Candidate Red victory is likely to result in pro-business policies focused on deregulation, lower taxes, and economic growth. Here’s how investors can take advantage of this scenario:

1. Predict Lower Taxes and a More Favorable Business Environment

With Candidate Red, the likelihood of lower corporate and capital gains taxes could lead to more favorable conditions for commercial real estate transactions. Investors might see higher after-tax returns, making it a great time to defer gains or hold assets using equity for longer periods.

For private lenders, lower taxes could increase borrowing activity for value-add projects or ground-up developments. At Rise, we’re preparing to take advantage of these tax cuts by focusing on short-term loans in sectors likely to experience accelerated growth under a Red administration, like residential, multifamily (including mobile home and RV spaces,) and industrial.

2. Look for Opportunities in Deregulated Sectors

Candidate Red’s focus on deregulation could benefit industries such as oil and gas, traditional energy, and commercial office space. Many of these businesses have a real estate component underneath them. Investors might consider increasing their exposure to these sectors, which may see a resurgence due to reduced regulatory hurdles.

For example, oil and gas properties or industrial warehouses could see higher demand and fewer restrictions, making them attractive targets for both short-term loans or equity partnerships.

3. Prepare for Growth in Defense and Infrastructure

Historically, Republican victories have often brought increased defense spending and infrastructure projects. These are areas where real estate investors can thrive, especially those investing in defense contractors or industrial real estate that supports military operations or large-scale construction projects.

We’re already positioning ourselves to capture opportunities in infrastructure-related real estate by looking at opportunities to both lend and partner on assets like industrial parks, which are likely to benefit from increased government contracts.

🥊 Election Results Disputes

With historical patterns in a tight race, inevitable election result disputes on behalf of either candidate can prolong significant uncertainty and volatility in the markets, and this can have both short- and long-term effects on investing. Following are some key ways disputes could impact investors and how to remain flexible as disputes are settled.

1. Market Volatility

Investors tend to react quickly to news, especially in liquid assets such as the stock market, and disputes may lead to panic selling, causing short-term dips in the market. This can create opportunities for investors who are well-positioned to buy assets at lower prices, but it can also increase the risk of making emotional decisions in response to market fluctuations.

Consider more illiquid and therefore less volatile investments during times of uncertainty. Private equity and private credit do not have daily ratings or evaluations the same way public markets do, and are more insulated from trading whims, historically increasing their time-weighted returns. Private and public markets do correlate, but the lag and lower liquidity allows for less reactive decision making.

Source: Hamilton Lane, The Truth Revealed: Private markets beats public markets - even after fees

2. Delayed Policy Implementation and Spending

Prolonged election disputes can delay the implementation of new policies, particularly in areas that affect tax laws, regulations, and government spending—all of which can significantly influence real estate and broader investment decisions. Investors may hesitate to commit capital during this period of uncertainty, leading to a temporary slowdown in transactions, particularly in the real estate sector.

Government spending plays a significant role in certain real estate sectors, such as infrastructure, housing development, and commercial projects. If disputes prolong the transition of power or policy formation, investors relying on government-backed projects or sectors that benefit from federal funding may face delays in executing their strategies.

You don't need to be one of those uncertain investors. Diversifying into more asset types and placing less capital in each can both yield gains and dampen losses while others are watching and waiting losing cash value to inflation.

3. Impact on Interest Rates and Economic Confidence

Election disputes can shake investor confidence, leading to concerns about economic stability. If disputes drag on, they may influence the Federal Reserve's decisions regarding interest rates or economic stimulus packages, particularly if economic growth begins to slow as a result. This can affect real estate by either tightening or loosening access to capital tied to the federal funds rate, depending on the broader economic response.

Private credit such as hard money loans have stable interest rates around 10-12% and do not react to Fed rate changes. They can insulate from these swings and keep capital available for properties needing heavy value add renovations before going on the traditional market.

4. Strategic Opportunities for Savvy Investors

For well-prepared investors, election disputes can create opportunities. Markets may temporarily underprice assets due to uncertainty, creating buying opportunities in sectors like multifamily housing, industrial properties, or value-add commercial properties. Investors who have liquidity on hand and can navigate volatility may find better deals during times of heightened uncertainty.

"Buy low and sell high" is never more apparent that in markets with sagging prices, yet few are certain enough to make decisive moves during the types of slow downs. It's how fortunes are made. Coupled with diversification with partial and non-correlated assets, it provides both opportunity and safety.

5. Long-Term Planning vs. Short-Term Risk

Ultimately, investors with a long-term perspective should focus on how their investments will perform over the coming years rather than reacting to short-term political disputes. Having a clear, diversified strategy helps manage risk during uncertain times. Real estate, particularly sectors like multifamily or industrial, tends to provide more stable, income-driven returns, which can help buffer against market volatility tied to political events. The longer time horizon allows these investments to weather uncertainty before selling decisions need to be made up against a maturing loan term.

Combining a long-term outcome with short-term cash flow allows both insulation and flexibility. This is why we focus on private renovation loans to "keep the lights on," and the frequent return of capital with lending allows us to reassess longer-term opportunity conditions more often.

The best approach during election disputes is to stay flexible, ensure we have diversified portfolios, and insulate at least a portion of our portfolio from knee-jerk reactions to public market swings. By preparing for both short-term disruptions and long-term trends, investors can protect their capital and potentially find new opportunities in a period of uncertainty.

Choose Which Plan to Start Executing Now

With two possible outcomes, how do you decide which plan to start working on before the election? Here’s how to approach this critical decision.

1. Assess Your Current Portfolio Exposure

Look at where you’re currently invested. Are you heavily concentrated in sectors that may struggle under a Blue administration, such as oil and gas or traditional energy? If so, it may be time to start diversifying into multifamily housing, industrial real estate, or renewable energy. Conversely, if you’re deeply invested in areas that could thrive under a Red administration, like hospitality or office, you might want to hold steady.

2. Hedge Against the Less Favorable Outcome

Regardless of which candidate you expect to win, hedge your bet. If Candidate Blue’s policies would hurt your portfolio the most, begin reallocating into sectors that can withstand a more regulated environment. If Candidate Red’s policies concern you more, start shifting toward assets that can thrive in a deregulated, pro-growth landscape.

One example is to consider short-term hard money loans that allow flexibility in case of a shift in market conditions, or investments in defensive real estate sectors like multifamily housing or self-storage, which recover well in most political climates and recessions.

3. Prepare for Tax Changes Now

With the possibility of significant tax changes, now is the time to start executing tax-efficient strategies. Harvest gains before tax rates rise if you’re concerned about a Blue victory, or prepare to hold assets longer under a Red administration’s likely tax cuts. Consider how to use depreciation from unearned income from rents or dividends to offset earned income from salary or interest payments. We prefer having a "non-employed" spouse become a real estate professional managing the portfolio for the best tax outcomes. However, if both spouses are working and don't qualify, consider investing earned income investments such as private loans inside a tax-advantaged IRA and keep depreciating investments in cash accounts.

Final Thoughts: Start Executing One of Your Plans Today

Waiting for election results to decide your next move costs you time in compounding, the biggest risk to your portfolio. While hasty decisions are also risky, the most successful real estate investors prepare early for a variety of outcomes and start executing their worst-case scenarios before the results are in, then pivot as more data becomes available.

Investing is rarely a sideline sport as the opportunity cost is often too high to wait and see. Weigh the possibilities, identify strategies appropriate to current market conditions, and execute, even if slowly. The time to act is now.

At Rise Capital, we’ve been helping our investors lock in gains and structure portfolios to remain tax-efficient, no matter what the election results will bring by actively preparing for either election outcome. We have positioned our fund portfolio across sectors that will thrive in either scenario, as well as added more investments managed by others to increase our diversification footprint. By making adjustments today, you can ensure your investments are protected and positioned for growth—no matter who wins.

Visit our accredited investor portal to see what WE are investing in for our own early retirement: investor.avestorinc.com/risecapital